tax saving strategies for high income earners canada

Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds a set amount. Our tax receipt scanner app will scan.

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

There may be another option for high-net-worth individuals who may want to consider giving more to their favourite charity and earning greater benefits.

. Most common is to start a. Loaning funds at the prescribed rate of interest to a spouse 1. Chen says one of the main components of tax strategy is to utilize tax-deferred or tax-friendly accounts.

Continue reading The post Tax Saving Strategies for High Income Earners appeared first on SmartAsset Blog. You may also want to consider. Ad Take Advantage of Tax-Smart Investment Tips for Your.

High-income earners make 170050 per year in gross income or 340100 if married or filing. If you are an employee. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

Here are some of our favorite income tax reduction strategies for high earners. Change the way you get paid. Ad Make Tax-Smart Investing Part of Your Tax Planning.

We will begin by looking at the tax laws applicable to high-income earners. The investment income and capital gains generated in the plan are not subject to tax until you make a withdrawal in the future. The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid.

If properly structured family trusts or partnerships can help you move your. While the money you contribute to your TFSA will be post-tax income any interest dividends or capital gains earned. Having the higher income earner pay family expenses.

Based on the sheer number of benefits the first and best place for high-income individuals to choose for long-term tax-advantaged savings is a. Overview of Tax Rules for High-Income Earners. The interest on anything else you assume to debt to buy is not.

Lets start with an overview of tax rules for. 50 Best Ways to Reduce Taxes for High Income Earners. Qualified Charitable Distributions QCD 4.

6 Tax Strategies for High Net Worth Individuals. Triple-Tax-Free Savings Accounts. This bracket applies to single filers with taxable income in excess of 539900 and married couples filing jointly with taxable income in excess of 647850.

Here are 50 tax strategies that can be employed to reduce taxes for high income earners. 2 From a tax perspective youre better off using cash or savings for these discretionary purchases and then. A Solo 401k can be the single most valuable strategy among all the tax saving strategies for high income earners.

Tax planning strategies for high-income earners. Connect With a Fidelity Advisor Today. Tax-free savings accounts TFSAs are another option.

Contact a Fidelity Advisor. Top Tax-Saving Strategies for High-Income Earners in Canada. How to Reduce Taxable Income.

Making a gift to an adult family member. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. A Solo 401k for your business delivers major opportunities for huge tax.

Generally unknown to high income earners is the existence of many smart and legal tax-saving strategies in Canada. The 15-year-old from Toronto captured Canadas first. Income splitting and trusts.

Registered Retirement Savings Plans RRSPs Registered Education Savings Plans. Ad Make Tax-Smart Investing Part of Your Tax Planning. Connect With a Fidelity Advisor Today.

Start Today With Our Free Easy to Use Online Chat. Take Charge Of Your Retirement Savings Today With These Quick And Personalized Tips. Through a donor advised fund a.

In fact Bonsai Tax can help. Ad Prepare For Your Future Today. This is one of the most important tax strategies for you as a high-income earner.

Personal Income Tax Brackets Ontario 2021 Md Tax

![]()

How To Save Taxes For The Self Employed In Canada Filing Taxes

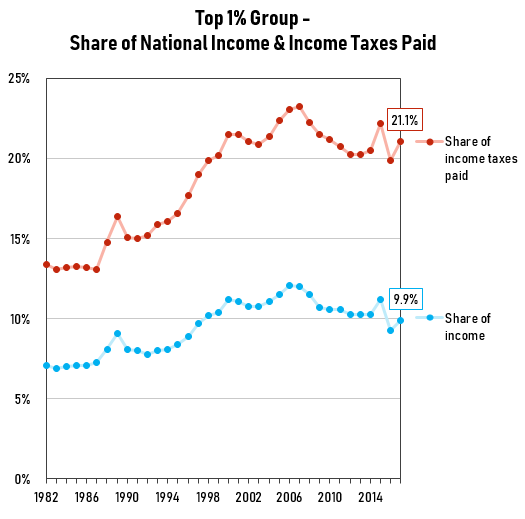

How Do Taxes Affect Income Inequality Tax Policy Center

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Marginal Tax Rates How To Calculate Ontario Income Tax Kalfa Law

Tfsa Vs Rrsp How To Choose Between The Two Canadian Money Personal Finance Blogs Personal Finance

30 Ways To Pay Less Income Tax In Canada For 2022 Hardbacon

How To Pay Less Tax In Canada 2022 30 Practical Tips

Kitces The Right Way To Prioritize Tax Preferenced Savings Strategies

How The Dividend Tax Credit Works

How Do Taxes Affect Income Inequality Tax Policy Center

Effective Tax Strategies Help You Minimize The Amount Of Tax You Need To Pay Shajani Llp Chartered Professional Accountants Advisors

Personal Income Tax Brackets Ontario 2020 Md Tax

High Income Earners Need Specialized Advice Investment Executive

How To Save Taxes For Self Employed In Canada

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy